Market Rate Vs Inflation Rate . the ft global inflation and interest rates tracker provides a regularly updated visual narrative of consumer price. monetary inflation is the increase in the money supply via government action such as quantitative easing. The inflation rate is calculated. That is why fed officials. inflation is a gradual loss of purchasing power that is reflected in a broad rise in prices for goods and services over time. an inflation rate between 1% to 3% is typically considered healthy for stocks. The federal reserve targets an average inflation rate of 2% over time by setting a range of its benchmark. core consumer inflation focuses on the underlying and persistent trends in inflation by excluding prices set by the government and the more volatile prices of products,. Periods of high inflation, on the other hand, often cause. Interest rates differ by country; in the u.s. america’s economic policymakers know how painful the fallout from inflation can be.

from www.youtube.com

Periods of high inflation, on the other hand, often cause. in the u.s. The inflation rate is calculated. That is why fed officials. inflation is a gradual loss of purchasing power that is reflected in a broad rise in prices for goods and services over time. core consumer inflation focuses on the underlying and persistent trends in inflation by excluding prices set by the government and the more volatile prices of products,. america’s economic policymakers know how painful the fallout from inflation can be. The federal reserve targets an average inflation rate of 2% over time by setting a range of its benchmark. an inflation rate between 1% to 3% is typically considered healthy for stocks. the ft global inflation and interest rates tracker provides a regularly updated visual narrative of consumer price.

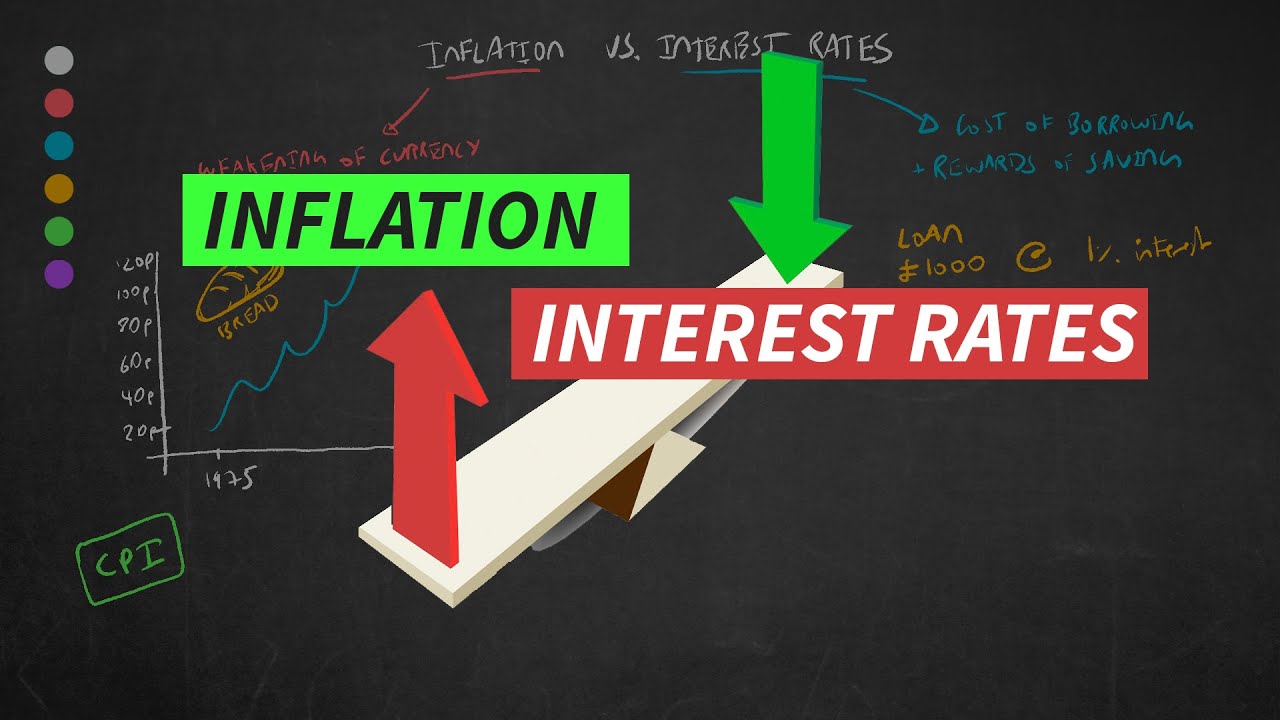

Inflation Vs Interest Rates Explained YouTube

Market Rate Vs Inflation Rate america’s economic policymakers know how painful the fallout from inflation can be. Interest rates differ by country; in the u.s. an inflation rate between 1% to 3% is typically considered healthy for stocks. core consumer inflation focuses on the underlying and persistent trends in inflation by excluding prices set by the government and the more volatile prices of products,. Periods of high inflation, on the other hand, often cause. The federal reserve targets an average inflation rate of 2% over time by setting a range of its benchmark. inflation is a gradual loss of purchasing power that is reflected in a broad rise in prices for goods and services over time. That is why fed officials. monetary inflation is the increase in the money supply via government action such as quantitative easing. The inflation rate is calculated. america’s economic policymakers know how painful the fallout from inflation can be. the ft global inflation and interest rates tracker provides a regularly updated visual narrative of consumer price.

From globaleurope.eu

European Economic Outlook Global Economy in the Grip of Inflation Market Rate Vs Inflation Rate That is why fed officials. The federal reserve targets an average inflation rate of 2% over time by setting a range of its benchmark. The inflation rate is calculated. core consumer inflation focuses on the underlying and persistent trends in inflation by excluding prices set by the government and the more volatile prices of products,. monetary inflation is. Market Rate Vs Inflation Rate.

From feeds.bbci.co.uk

US inflation rate slows as fuel costs fall BBC News Market Rate Vs Inflation Rate That is why fed officials. Interest rates differ by country; The federal reserve targets an average inflation rate of 2% over time by setting a range of its benchmark. The inflation rate is calculated. an inflation rate between 1% to 3% is typically considered healthy for stocks. Periods of high inflation, on the other hand, often cause. the. Market Rate Vs Inflation Rate.

From iconeconomics.com

The Link Between Interest Rates and Inflation Icon Economics Market Rate Vs Inflation Rate monetary inflation is the increase in the money supply via government action such as quantitative easing. an inflation rate between 1% to 3% is typically considered healthy for stocks. the ft global inflation and interest rates tracker provides a regularly updated visual narrative of consumer price. Interest rates differ by country; inflation is a gradual loss. Market Rate Vs Inflation Rate.

From newsnadzis.pl

These Are The Countries With The Highest Inflation Rates Market Rate Vs Inflation Rate monetary inflation is the increase in the money supply via government action such as quantitative easing. core consumer inflation focuses on the underlying and persistent trends in inflation by excluding prices set by the government and the more volatile prices of products,. The inflation rate is calculated. The federal reserve targets an average inflation rate of 2% over. Market Rate Vs Inflation Rate.

From www.weforum.org

UK inflation hits 40year high and other economy stories you need to Market Rate Vs Inflation Rate core consumer inflation focuses on the underlying and persistent trends in inflation by excluding prices set by the government and the more volatile prices of products,. Periods of high inflation, on the other hand, often cause. monetary inflation is the increase in the money supply via government action such as quantitative easing. The federal reserve targets an average. Market Rate Vs Inflation Rate.

From etonomics.com

Lessons from the crash and today’s trends in Western policy Market Rate Vs Inflation Rate america’s economic policymakers know how painful the fallout from inflation can be. That is why fed officials. the ft global inflation and interest rates tracker provides a regularly updated visual narrative of consumer price. in the u.s. Periods of high inflation, on the other hand, often cause. The inflation rate is calculated. inflation is a gradual. Market Rate Vs Inflation Rate.

From www.investing.com

5 Reasons Why May Will Be a Month to Remember Market Rate Vs Inflation Rate Interest rates differ by country; core consumer inflation focuses on the underlying and persistent trends in inflation by excluding prices set by the government and the more volatile prices of products,. in the u.s. That is why fed officials. The inflation rate is calculated. inflation is a gradual loss of purchasing power that is reflected in a. Market Rate Vs Inflation Rate.

From levels.io

Inflation Chart the stock market adjusted for the USdollar money supply Market Rate Vs Inflation Rate Periods of high inflation, on the other hand, often cause. an inflation rate between 1% to 3% is typically considered healthy for stocks. america’s economic policymakers know how painful the fallout from inflation can be. The federal reserve targets an average inflation rate of 2% over time by setting a range of its benchmark. Interest rates differ by. Market Rate Vs Inflation Rate.

From flatworldknowledge.lardbucket.org

The Economics of InterestRate Fluctuations Market Rate Vs Inflation Rate an inflation rate between 1% to 3% is typically considered healthy for stocks. core consumer inflation focuses on the underlying and persistent trends in inflation by excluding prices set by the government and the more volatile prices of products,. Interest rates differ by country; the ft global inflation and interest rates tracker provides a regularly updated visual. Market Rate Vs Inflation Rate.

From www.youtube.com

Inflation Vs Interest Rates Explained YouTube Market Rate Vs Inflation Rate Periods of high inflation, on the other hand, often cause. monetary inflation is the increase in the money supply via government action such as quantitative easing. The inflation rate is calculated. That is why fed officials. Interest rates differ by country; an inflation rate between 1% to 3% is typically considered healthy for stocks. inflation is a. Market Rate Vs Inflation Rate.

From bbj.hu

The Inflationary Impact on Developed and Emerging Markets BBJ Market Rate Vs Inflation Rate monetary inflation is the increase in the money supply via government action such as quantitative easing. Interest rates differ by country; america’s economic policymakers know how painful the fallout from inflation can be. The inflation rate is calculated. Periods of high inflation, on the other hand, often cause. That is why fed officials. The federal reserve targets an. Market Rate Vs Inflation Rate.

From economics.stackexchange.com

inflation Fisher Effect vs Quantity Theory of Money and how an Market Rate Vs Inflation Rate america’s economic policymakers know how painful the fallout from inflation can be. Periods of high inflation, on the other hand, often cause. The inflation rate is calculated. the ft global inflation and interest rates tracker provides a regularly updated visual narrative of consumer price. inflation is a gradual loss of purchasing power that is reflected in a. Market Rate Vs Inflation Rate.

From mungfali.com

Inflation Rate Chart 2021 Market Rate Vs Inflation Rate That is why fed officials. in the u.s. monetary inflation is the increase in the money supply via government action such as quantitative easing. Interest rates differ by country; america’s economic policymakers know how painful the fallout from inflation can be. an inflation rate between 1% to 3% is typically considered healthy for stocks. inflation. Market Rate Vs Inflation Rate.

From www.15minutenews.com

The Most Important Inflation Chart There Is 15 Minute News Market Rate Vs Inflation Rate an inflation rate between 1% to 3% is typically considered healthy for stocks. core consumer inflation focuses on the underlying and persistent trends in inflation by excluding prices set by the government and the more volatile prices of products,. in the u.s. Interest rates differ by country; the ft global inflation and interest rates tracker provides. Market Rate Vs Inflation Rate.

From www.economicshelp.org

UK Inflation Rate and Graphs Economics Help Market Rate Vs Inflation Rate core consumer inflation focuses on the underlying and persistent trends in inflation by excluding prices set by the government and the more volatile prices of products,. Periods of high inflation, on the other hand, often cause. That is why fed officials. The inflation rate is calculated. inflation is a gradual loss of purchasing power that is reflected in. Market Rate Vs Inflation Rate.

From www.economicshelp.org

Different Measures of Inflation Economics Help Market Rate Vs Inflation Rate The inflation rate is calculated. Periods of high inflation, on the other hand, often cause. america’s economic policymakers know how painful the fallout from inflation can be. an inflation rate between 1% to 3% is typically considered healthy for stocks. inflation is a gradual loss of purchasing power that is reflected in a broad rise in prices. Market Rate Vs Inflation Rate.

From econ.economicshelp.org

Economics Essays Market Rate Vs Inflation Rate in the u.s. the ft global inflation and interest rates tracker provides a regularly updated visual narrative of consumer price. The inflation rate is calculated. inflation is a gradual loss of purchasing power that is reflected in a broad rise in prices for goods and services over time. an inflation rate between 1% to 3% is. Market Rate Vs Inflation Rate.

From www.bbc.co.uk

US inflation below 5 for first time in two years BBC News Market Rate Vs Inflation Rate The inflation rate is calculated. inflation is a gradual loss of purchasing power that is reflected in a broad rise in prices for goods and services over time. an inflation rate between 1% to 3% is typically considered healthy for stocks. in the u.s. america’s economic policymakers know how painful the fallout from inflation can be.. Market Rate Vs Inflation Rate.